Activity

What would faster settlements and seamless transactions mean for your business?

With the global shift towards shorter securities settlement cycles, end-to-end transparency and real-time visibility are more important than ever.

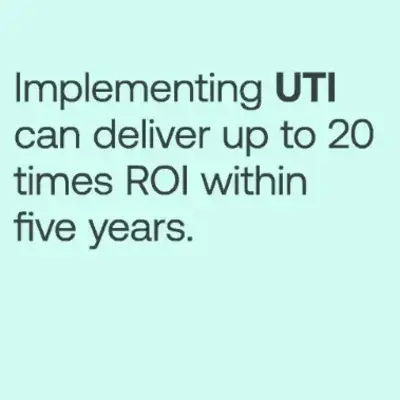

A new Accenture study reveals the ROI potential and makes a compelling case for why you should consider adopting the Unique Transaction Identifier (UTI).

Why Unification, AI, and Data Completeness are Now Non-Negotiable

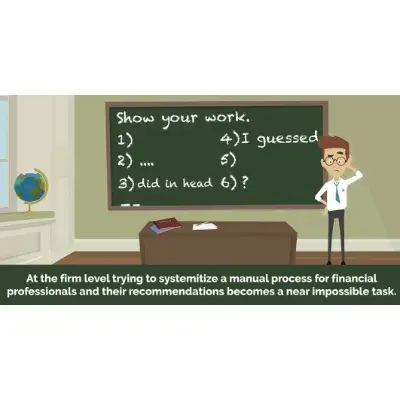

Regulators are tightening their grip on digital communications oversight. In the U.S. alone, the SEC has imposed $2.6 billion in fines on firms for failures in communications management.

Despite significant investment, many institutions still operate with fragmented systems, incomplete data, and outdated processes that expose them to regulatory, operational, and reputational risk.

To better understand how Tier 1 and Tier 2 banks are addressing these challenges, we partnered with GreySpark Partners to survey compliance leaders. The findings were clear: Compliance frameworks must evolve, and quickly.

Stablecoins: The bridge between traditional finance and digital assets

The GENIUS Act, enacted in July 2025, has introduced a regulatory framework for payment stablecoins, digital assets designed to maintain a stable value relative to a sovereign currency like the US dollar. This comprehensive whitepaper, "Stablecoins: The Bridge Between Traditional Finance and Digital Assets," delves into the implications of the Act for both the stablecoin market and traditional financial institutions, providing a detailed analysis that is essential for finance professionals, banks, and corporate treasurers.